Use the Sales Tax Deduction Calculator Internal Revenue Service

Sales tax is a type of tax that’s charged at the time an item or service is sold. The buyer pays the tax to you, and you remit the tax to the relevant government tax collection body. The taxes that are collected by each agency are then sent to various departments at the local, county, and state levels to ensure their ongoing operations and functions.

You have to charge the sales tax according to the state your buyer lives in, and you need to send the tax you collect to the destination state. The two previous steps can be combined using a little trick about percentages. The original purchase price of the television is $250.00, which is 100% of the purchase price.

Knowing how to charge sales tax isn’t always a straightforward process, as the sales tax rules are different at all levels. Some states have a base sales tax rate that local municipalities can add to, while other states have no sales tax at all. Some states do not charge sales tax on specific categories of items. In Massachusetts for example sales tax is not charged on regular grocery items. In the hospitality industry it is common for restaurants and hotels to charge a tax rate higher than the state sales tax rate.

Sales tax rates are increasing, which makes the tax impact on a purchase more significant. Use these tips to learn how to calculate sales tax on your retail purchases. Value-added tax (VAT) systems levy consumption taxes on goods and services at every stage of the supply chain where value is added. Whether you’re trying to get back to the pre-tax price of an item or you’re calculating the amount of sales tax backwards from a receipt in your hand, the math is the same.

What states don’t charge sales tax?

They are subject to ordinary income tax rates meaning they’re taxed federally at either 10%, 12%, 22%, 24%, 32%, 35%, or 37%. Use our free sales tax calculator above to return a sales tax rate specific to any US street address. Occasionally a product or service is listed with the sales tax already included in the total price. If the tax rate for the area is known, the sales tax paid on that purchase can be calculated. A sales tax is a mandatory amount that the government charges on items purchased by consumers and businesses. The government uses the money obtained from sales taxes for things such as education, health care, road repairs, and transit.

In the United States, sales tax at the federal level does not exist. At the state level, all (including District of Columbia, Puerto Rico, and Guam) but five states do not have statewide sales tax. These are Alaska, Delaware, Montana, New Hampshire, and Oregon. States that impose a sales tax have different rates, and even within states, local or city sales taxes can come into play.

Sales Tax Decalculator

For example, to calculate the total price with tax for a $13.50 movie ticket at a sales tax rate of 7.7%, substitute the known values. All governments must generate revenue of some kind to pay for the services they provide, like road maintenance, healthcare, education, fire, and police. It also needs funding for the costs of governing, such as government employee salaries, property leases, and general operating expenses. The most common way for governments to raise money is through taxes. Taxes are mandatory fees that are applied to money, property, goods, or services. This taxation without representation, among other things, resulted in the Boston Tea Party.

In other words, a 7% tax rate would become 0.07 (7 / 100) when it’s converted. The total amount of sales tax that Melissa must pay on her $50 purchase is $3.50 ($50 x .07). Most taxpayers choose to deduct income taxes as it typically results in a larger figure. With that said, it may be better for taxpayers who made large purchases during the year to deduct sales tax instead of income tax if their total sales tax payments exceed state income tax. Taxpayers who paid for a new car, wedding, engagement ring, vacation, or multiple major appliances during a tax year can potentially have a greater sales tax payment than income tax payment.

Instructure Announces Second Quarter 2023 Financial Results – PR Newswire

Instructure Announces Second Quarter 2023 Financial Results.

Posted: Mon, 31 Jul 2023 20:05:00 GMT [source]

Sales tax is a simple calculation based on the percentage of a retail price of a good or service. To calculate it, convert the sales tax percentage to a decimal, then multiply it by the retail price of the product or service. To calculate the sales tax in dollars, simply multiply the purchase price by the sales tax rate.

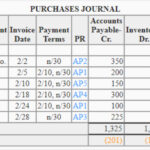

How to Account for Sales Tax Paid for an Inventory

Some of the earlier attempts at sales tax raised a lot of problems. Sales tax didn’t take off until the Great Depression, when state governments were having difficulty finding ways to raise revenue successfully. Of the many different methods tested, sales tax prevailed because economic policy in the 1930s centered around selling goods.

- Using your income information, we’ll look for any tax credits that will either impact your refund or the amount you owe, as well as deductions to lower your taxable income.

- To find the tax, multiply the pre-tax total times .11 (the decimal form of 11%).

- In the event the tax rate is a percentage, you drop the percentage sign and divide the tax amount by 100 to get the decimal numbers for the tax rate.

- Both of these errors increase your company’s risk of audit penalties, fines, and fees.

- In addition to this content, she has written business-related articles for sites like Sweet Frivolity, Alliance Worldwide Investigative Group, Bloom Co and Spent.

In reality, less than 2% of Americans claim sales tax as a deduction each year. The state sets a base sales tax rate, and local governments are free to add their own tax to the rate. For example, the state sets its rate at 3.25%, the county adds another 1.25%, and the local government adds another .50%.

Brush up on income tax basics.

Last, we need to create a proportion where the pre-tax cost is related to 100% and solve for the percentage of the sales tax. If a person pays $245.64 for groceries that cost $220.00 pre tax, then what is the sales tax percentage for the items. VAT is the version of sales tax commonly used outside of the U.S. in over 160 countries. VAT is an indirect tax that is imposed at different stages of the production of goods and services, whenever value is added. Countries that impose a VAT can also impose it on imported and exported goods. VAT can be calculated as the sales price minus the costs of materials or parts used that have been taxed already.

Plastic Packaging Tax – chemical recycling and adoption of a mass … – GOV.UK

Plastic Packaging Tax – chemical recycling and adoption of a mass ….

Posted: Tue, 18 Jul 2023 07:00:00 GMT [source]

Understand origin vs. destination sales tax laws to determine whether you collect sales tax using your primary or secondary state’s tax rate. Value-added tax, or VAT, is a tax that’s added at each stage of the production of an item. A product becomes worth more at each stage of its transformation. Ingredients and materials what is posting in accounting are subject to a tax, then as these items are turned from a raw material into a good, more tax is added. Once the good has been completed, packaged, and shipped to market, it’s reached its final tax amount. The consumer buys the item with the tax already factored in and pays the face price with no additional taxes charged.

How to calculate sales tax

If you have tax rate as a percentage, divide that number by 100 to get tax rate as a decimal. Another consideration is that sales tax may be charged for online sales, depending on whether the seller is considered to have nexus in a state. Generally, for tax purposes, nexus is understood to mean a physical presence, such as a warehouse, office, or employee who resides in the state.

- In general, taxpayers with sales tax as their only deductible expense may find that itemizing deductions is not worth the time.

- All right, let’s take a moment to review what we’ve learned.

- Alaska, for example, has no state sales tax, but many municipalities within Alaska levy sales taxes that range from 1% to 7%.

- Calculating the sales tax backward isn’t always easy, particularly because state sales taxes in different states can vary considerably.

We’ll calculate the difference on what you owe and what you’ve paid. If you’ve already paid more than what you will owe in taxes, you’ll likely receive a refund. Find out how real estate income like rental properties, mortgages, and timeshares affect your tax return.

In the event you’re selling at a physical location in another state, you have to collect sales taxes for that state and remit them to that state’s department of revenue. Always check state rules and regulations prior to collecting and remitting sales tax prior to making your first sale in order to be in compliance. It consists of converting the sales tax percentage to a decimal number, then multiplying the cost of the item by the decimal number to get the amount of sales tax you collect.

Some states have both a state-level and local sales tax rate. You should have a good grasp of all of them if you have a small business and you regularly engage in online sales. All right, let’s take a moment to review what we’ve learned. As we learned, sales tax is a mandatory amount that the government charges on items purchased by consumers and businesses. Individual stores add sales tax to the cost of the purchase and they collect sales taxes on behalf of the government. Stores don’t get to keep these tax dollars as they must be sent to the government.